What is grit? I’ve heard this word a lot recently. And of course, the obvious supplementary question is, why is it important?

I’m referring to a term used in psychology to represent a positive, non-cognitive personality trait based on an individual’s perseverance of effort combined with the passion for a particular goal and a powerful motivation to achieve it. Allow me to explain.

What is grit?

Have you ever noticed that the smartest people are not always the most successful? Success can be defined in different ways, but for most people, their measure would usually revolve around money and prestige.

If we take money as the measure of success, then you’d think the smartest people would easily come out on top of that score, surely? Yet you’d be wrong.

We hear stories frequently about college professors who struggle financially, while at the same time, tradesmen like bricklayers and plumbers become millionaires. How can that be?

Surely the smartest people have a natural advantage? Well, no, they don’t.

The people with the real, innate advantage are those with this quality known as grit.

So, exactly what is grit?

It is an inner steeliness. It is courage and resolve. It is a strength of character. It is drive and desire. It is passion and motivation.

It is a willingness to persevere until the desired result is achieved. It is a determination to achieve a goal and a willingness to take calculated risks.

It is a fact that doing well in life depends on much more than academic ability and your capacity to learn quickly and easily.

Having those qualities is useful, of course, but in the absence of grit, you’d still be at a disadvantage.

Someone of average academic ability but with a shedload of grit will be better placed to achieve real success in life.

People with grit intuitively recognize that life is a marathon, not a sprint.

They’re willing to experience failure because they know that failure is a temporary outcome, not a permanent position. And they’re willing to fail and then start over using the lessons they’ve learned from the experience.

So what’s the key to success? It’s the need to get grittier!

Angela Lee Duckworth makes this point admirably in this excellent TEDxTalk video, and it’s well worth a few minutes of your time. It’s an interesting video, and I think she nails the point perfectly.

That’s what I think, but what is your opinion?

Could there be such an easy answer, or is it all much more complicated? I’d be interested to hear your views.

Grit: The power of passion and perseverance:

Please share this post with your friends:

Did you find this article interesting and useful, dear reader?

If so, then please share it on social media with your friends. When you share, everyone wins.

So please share it now. If you do, I’ll be ever so grateful, and you’ll be helping a keen blogger reach a wider audience.

Thank you.

Articles you might also find interesting:

- How will your life be measured? Here’s what matters most

- 11 wise sayings about life lessons and what they mean

- 10 very useful tips to be successful in life

- The importance of making mistakes to achieving success

- The importance of friends to our lives

- 15 Quotes by Barbara Sher to inspire you

- 15 quotes to emphasize the importance of time management

- Goal-setting and how to achieve them

- Why you should let your child fail and make mistakes

- Why your personal philosophy for life really matters

- 25 facts of life that might get you thinking

- 8 Top Business Tips for Success Today

- 10 tips for improving self-esteem

- Why passion is the key to success

- How to handle criticism at work effectively

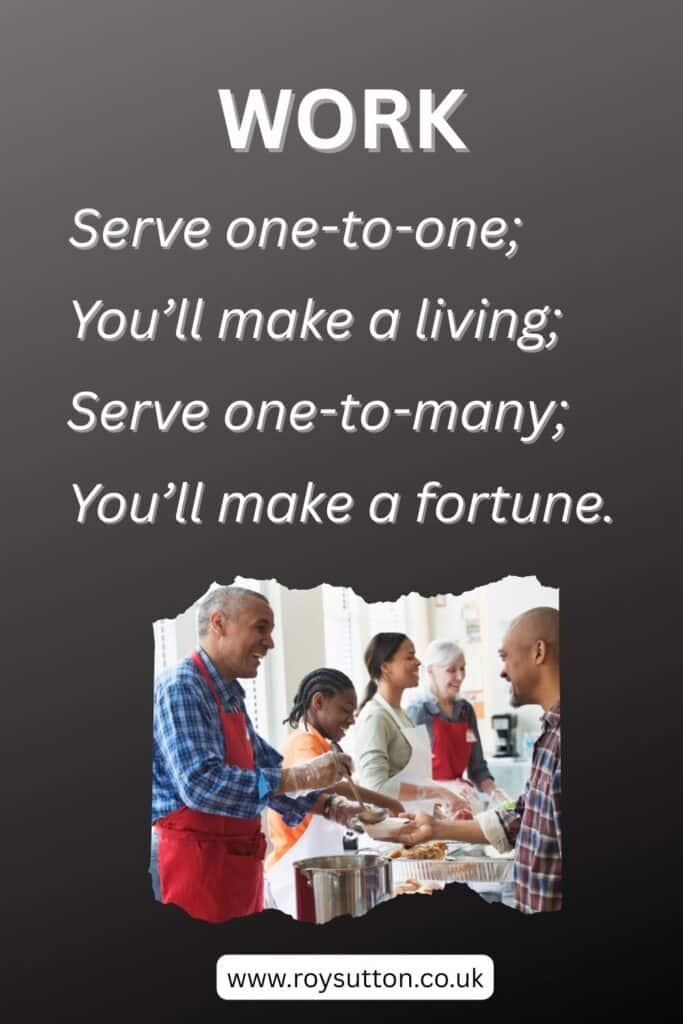

- 3 ways for getting rich

- 5 ways to kill your dreams

- 33 life lessons learned that are best learned early

- How the power of words can change lives

- 10 steps for making new year’s resolutions

- Public Speaking: The Power of the Pause

- Productivity Tips: How to Structure Your Day

- George Carlin’s Top 10 Rules For Success

- 13 tips for improving your personal happiness

- Steve Jobs’ Top 10 Rules For Success to inspire you

- 25 inspirational stories of people going from rags to riches

© Mann Island Media Limited 2025. All rights reserved.

What is grit? What is grit? What is grit?