Today, I am considering the buying decision process.

If you want to create wealth, it starts with being sensible with your money.

So, the buying decision process is essential.

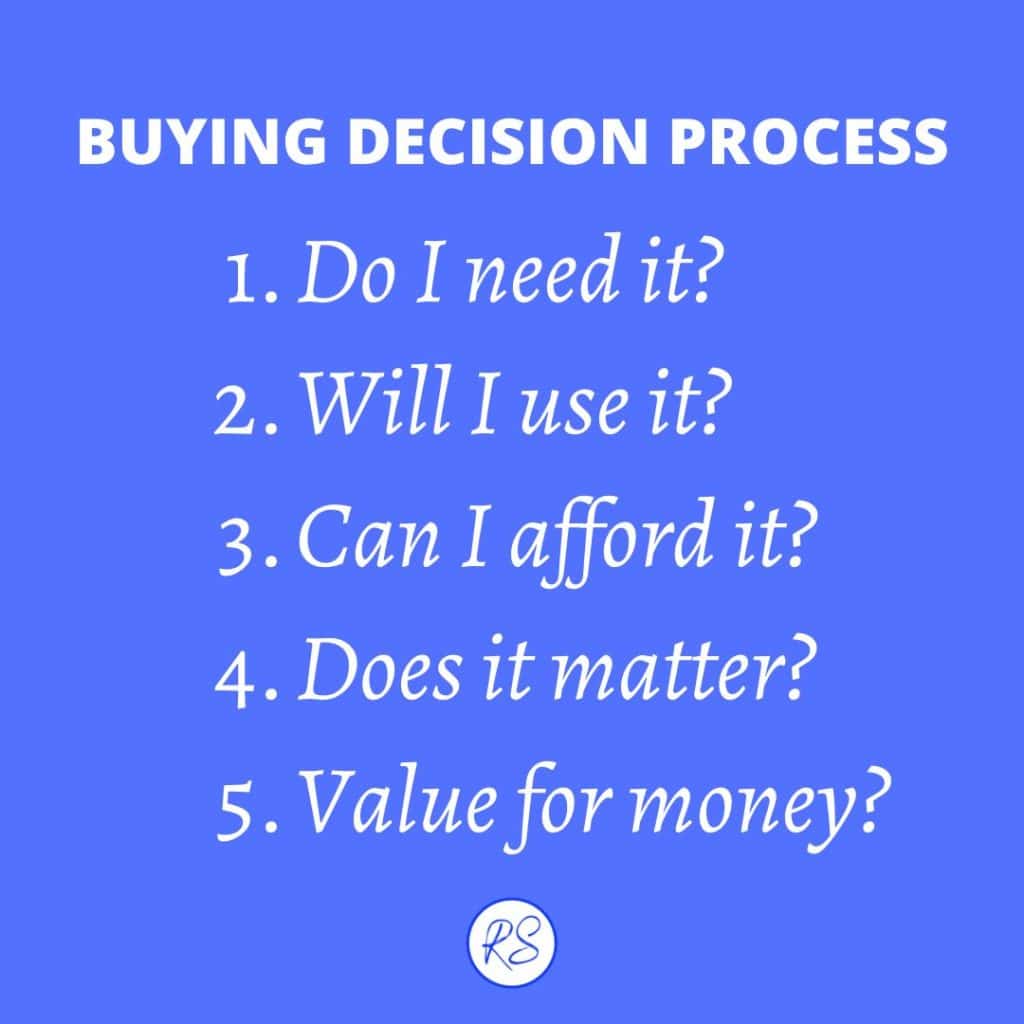

Buying decision process:

Now, how can you be expected to save money when you don’t earn enough to make ends meet as it is?

I’m guessing you may have asked yourself that question at least once, dear reader? If you have, you’re not alone. It’s a common challenge.

However, whilst some people may struggle financially, it’s also true that far too many people squander their money buying items they don’t need and probably will never use, often in an attempt to impress people they don’t even like.

For such people, their buying decision process is usually limited to whether they still have enough credit left on their credit cards.

Well, the mantra “Have Plastic; Will Purchase” is not a good one if saving money is one of your goals.

You can earn a decent income, and yet a lack of money management skills and poor buying decisions will result in you never achieving financial freedom. Poor money management skills will condemn you to a life of being poor.

So it’s essential that you learn to manage your money properly if you want to avoid long-term poverty.

Avoid the ‘I’ve got to have it’ approach:

So, be honest with yourself: how often do you buy things you didn’t need?

Stuff that you weren’t even looking for, but it was there, and it looked nice, and you thought, I’ve got to have it. Out pops your ‘flexible friend,’ and the item is yours. A brief period of gratification follows, and then the item is largely forgotten.

How often do you buy things you never use?

Take a look at your wardrobe. I’ll bet there are a few items in there that still have the store tags on them. Never used, and they’ve probably been there for quite some time, I suspect? Would I be right?

‘I’ve got to have it‘ is a great way to waste all your money. With this approach, you’ll enrich other people at your own expense. Now how could that possibly make sense?

Credit cards: Weapons of mass wealth destruction:

How often do you buy things you can’t afford with money you don’t have?

It’s true, credit cards can be a convenient means for making payments, of course, but they can also be weapons of mass wealth destruction. That’s a fact, dear reader.

When it comes to the buying decision process, most of us are driven more by a desire for gratification than by any sensible approach to managing our money carefully.

Most of us are guilty of buying more than we need. Many of us are guilty of buying items we seldom use, if at all.

If you’re like this, dear reader, then you’re not alone, I can assure you. However, that’s not a good thing.

The disciplined approach:

With discipline, you can hang on to more of your money and build capital, which, eventually, will start generating an income all of its own through interest payments on deposits and bonds, dividend payments, and capital growth on stocks and shares.

Still, we’re getting ahead of ourselves.

The underlying message I offer you today, dear reader, is that:

You should establish for yourself a buying decision process that will allow you to control your expenditure.

Essentially, before you buy anything, you need to ask yourself a series of tough questions to gauge whether the purchase makes good sense.

And what are those questions?

The questions to ask before making any purchase:

There are, in fact, five questions you should ask yourself before making any purchase, as follows:

- Do I need it? Honestly?

- Will I use it? Honestly?

- Can I afford it? Honestly?

- If I didn’t have it, would it matter?

- Does it represent value for money?

If you answer ‘No’ to the first four questions, the fifth question is irrelevant.

A negative on all or even most of the first four questions means don’t buy the item. Simple!

And even if you do think you need it, never buy anything if you do not have the money to pay for the item right now. Never, ever incur debt for a discretionary purchase.

It’s better to do without than to run up debt on a credit card to pay for discretionary purchases.

The compounding effect of high credit card interest rates can quickly turn a small debt into a large one.

The ‘value for money’ question is only relevant when you can answer every other question in the affirmative.

Nevertheless, you should never buy something that’s not also good value for money.

That is, you should never overpay for anything.

Overpaying means the price is inconsistent with the value on offer.

Let the answers to the questions guide you:

To ensure your buying decision process is sound, you must always ask these questions.

Let them be your purchasing guide, and you’ll be in a better position to start saving money and watch it grow.

Once it starts growing, you’ll be on your way to building your own personal wealth.

Please share this post with your friends:

Did you find this article interesting and useful?

If so, then please share it on social media with your friends.

When you share, everyone wins.

So please share it now. If you do, I will be forever grateful, and you’ll be helping a keen blogger reach a wider audience.

Thank you.

Roy Sutton is a writer, content creator, digital entrepreneur, and international traveller. Formerly, a CEO, corporate business executive, management consultant, and electronic systems engineer with a background in telecommunications and IT. His blog aims to both inspire readers to achieve their best lives and entertain them with the humour we all crave.

Other articles that might appeal to you:

- What is life’s most precious resource?

- Success and why you should never quit

- Does being a success really matter?

- 5 very powerful quotes with reflections on their meaning

- 11 wise sayings about life lessons and what they mean

- Why should I be positive?

- 5 powerful quotes and the wisdom within

- How to overcome laziness in 4 steps

- Absolutely guaranteed secret to success

- 35 short but brilliant one-liner quotes you’ll love

- 25 of the silliest jokes ever that’ll tickle your funny bone

- 60 British insults for getting your message across

- 25 witty one-liner jokes that might just make you smile

- 66 silly jokes and some of the funniest one-liners

- 29 examples of sarcasm for when you need a witty insult

- 30 sarcasm examples that’ll really make you smile

- 21 sarcasm quotes that are the sharpest form of wit

© Mann Island Media Limited 2025. All rights reserved.